PIMFA WealthTech acts as a clearing house by delivering structured showcases, known as Tech Sprints, of the latest technology innovations and solutions that address key problem statements faced by the sector

- There are over 2,500 FinTech firms based in the UK alone – this is estimated to more than double by 2030

- There are estimated to be more than 1,000 FinTech firms offering Wealth-based solutions

- 82% of incumbent firms in the wealth and advice sector expect to increase FinTech partnerships in the next three to five years

The opportunity to harness new technology and solutions to transform the industry across all aspects of the value chain is huge, but engagement is fragmented and uncoordinated

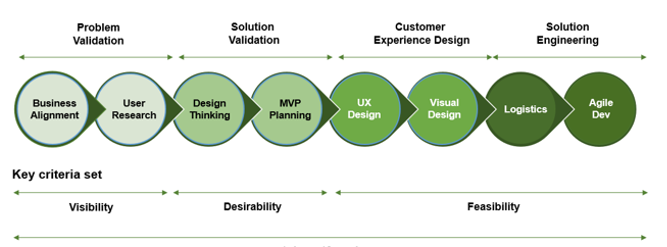

PIMFA WealthTech provides a coherent and systematic basis for visibility, connectivity and collaboration for Fintech and incumbent wealth and advice firms to close this gap

PIMFA WEALTHTECH: TECH SPRINTS METHODOLOGY

- 1. Identify areas of challenge and opportunity for the sector; develop a problem statement and call to action for the market

- 2. Collate expressions of interest from Fintech providers; evaluate and select a Tech Sprint cohort via a panel of industry practitioner expertise

- 3. Run a structured Tech Sprint with the cohort to align solutions and insights to the problem statement; a rapid showcase of existing solutions, rather than a ‘hackathon’

- 4. Solutions evaluated and findings shared with the sector; briefing events and reports to increase Fintech visibility

Completed Tech Sprints:

Tech Sprint carried out March 2024 – April 2024